Commercial Real Estate Syndication in India

Real estate investing can be difficult at times. Time, persistence, education, and, most importantly, a substantial initial financial investment are all necessary for real estate investing. Given the high cost of investment properties, it is not surprising that most inexperienced investors choose to invest in one of two ways: either purchase a fund or purchase an entire property through a syndicated arrangement.

Investing in real estate syndication is a great way to diversify your real estate holdings, boost their liquidity, and generate steady income flow. It’s also an inexpensive way to invest your money.

What Is A Real Estate Syndication?

A group of investors pools their money to purchase commercial real estate or create a brand-new structure in real estate syndication. For example, most people would struggle to decide whether to fund and construct a massive hotel on their own, but a syndicate consisting of just a few investors might be able to secure the capital.

In actuality, capital-seeking investors are typically paired with developers and experienced real estate specialists in real estate syndication.

This type of investment involves gathering a group of people to pool their money and purchase a property. Usually, this group consists of two to ten people, but on occasion, it can include hundreds of investors.

Real estate syndication is a great way to get involved in commercial real estate projects without going alone.

Current state of Real estate in India

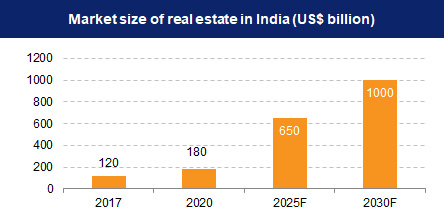

The market is projected to be worth USD 0.33 trillion in 2024 and grow at a CAGR of 25.60% to reach USD 1.04 trillion by 2029. India’s strong growth potential is leading to a high demand in offices and commercial space in Tier 1 and Tier 2 cities.

How Is Syndication Different From Crowdfunding?

Although crowdsourcing and syndication require different levels of investor expertise and entry capital, they share similar financing concepts and principles.

When we talk about real estate or credit syndication, we’re talking about a collective of investors who collectively fund a substantial asset. Initially, it appears that the purpose of crowdsourcing is also to support initiatives through the crowd.

However, syndication and crowdfunding differ in the target market and amount of investments.

The primary ways that syndicated investments and crowdfunding vary are in the ways that the platforms handle their communications with funders and investors, run their advertising campaigns, and handle the amount of money that is raised and invested.

Although crowdfunding investors do not have voting rights, they may still be able to influence decisions about things like the buying or selling of real estate, depending on whether the syndication is public or private.

Benefits of Real estate syndication

Investing in real estate syndication is a great way to diversify your real estate holdings, boost their liquidity, and generate steady income flow. It’s also an inexpensive way to invest your money. Investing in real estate with private funds is subject to even more strict laws.

Diversification

Diversification is one of the key elements of a real estate investment portfolio. This can be accomplished by investors by spreading their risk across multiple properties. They will be able to access more advantages and opportunities as a result, increasing the return on their investment.

Among the methods for obtaining diversified investments are syndications. Syndication works like this: a property is bought by an investor, who then splits the equity with a few other investors before selling it to the next buyer.

Because investors will have access to multiple properties but will only own a small portion of the entire potential property portfolio, the investment is diversified. This lowers the risk for each investor in the event that a specific property doesn’t perform as expected.

Syndications can also help diversify an investor’s investment portfolio by using real estate agents to handle and assist with all of the properties. These investment options have the benefit of giving investors and syndicators equal access to a sizable pool of investment opportunities without requiring any action on their part.

Tax Advantages

For investors who wish to take advantage of tax breaks and capitalise on the rising real estate market, companies that specialise in real estate syndication can be a great choice. An annual percentage rate (APR) is used to express the returns on real estate syndication investments.

Additionally, distributions of capital gains are frequently tax-free, but interest and dividend income are taxed as regular income. Furthermore, the capital gains tax rate is lower than the income tax rate. Many draw the following conclusions:

Interest on a mortgage. Real Estate Tax. Depreciation on Repairs and Operating Expenses (Accelerated)

Liquidity

Real estate syndications raise the values of the underlying properties. Investors have a range of options when it comes to investing. The most common type is an actively managed real estate asset portfolio overseen by a portfolio manager. Other options include exchange-traded funds, passively managed portfolios, and real estate investment trusts (REITs).

Tax-managed funds are another type of real estate investment trust that is commonly ignored. Both active and passive real estate strategies are included in these funds, but they are managed by separate entities.

Because the management and investment strategies are separated, it enables more stringent control and consistent outcomes. Certain private real estate funds don’t have the same transparency and liquidity as real estate syndication

Reduced Volatility Risk

Compared to real estate syndication, private real estate funds are more erratic. Financial loss is a possibility if real estate values drop. If you buy a lot of shares at a discount in a private real estate fund and real estate values drop, you might lose money.

With syndication, there is less risk of volatility. As a long-term investment, they can be kept for a very long time. You won’t have to sell your properties when their values drop; instead, you can hang onto them and wait for the market to recover. It allows you to hold onto your investment for longer stretches of time without having to sell it at a loss.

Bottom Line

Real estate syndications are a lucrative choice for investors looking to reduce risk and diversify their investment portfolio. Thanks to investor support, investors can take advantage of a wide range of properties and benefit from increased freedom and responsibility when managing a property remotely. Additionally, for those seeking high returns at low risk, this kind of alternative investment is worth considering, provided they are prepared to conduct some independent research.

Ready to embark on your commercial real estate investment journey? Assetmonk is one of India’s fastest-growing real estate platforms, with opportunities for real estate investment in major cities like Hyderabad, Chennai, and Bangalore. Our expertise is identifying opportunities with high yields within the retail, office, and industrial asset classes.

We offer real estate properties with investment opportunities that are carefully listed after conducting strict and professional due diligence. To start your investment with us today, visit us now!

FAQs

Q1. What is commercial real estate syndication?

A. Commercial real estate syndication is a form of investment where multiple investors pool their funds to collectively invest in large-scale commercial real estate projects. These projects can include office buildings, retail centers, hotels, or industrial properties. Syndication allows investors to access opportunities that may be beyond their individual financial means and diversify their real estate portfolios.

Q2. Why should I consider investing in commercial real estate syndication in India?

A. Investing in commercial real estate syndication in India offers several advantages. Firstly, it provides access to lucrative commercial properties that may not be available to individual investors. Secondly, it allows for diversification of investment risks across different properties and locations. Finally, it offers potential passive income and long-term appreciation of invested capital.

Q3. Can I exit my investment before the completion of the commercial real estate project?

A. The ability to exit an investment before the completion of the commercial real estate project depends on the terms and conditions outlined in the syndication agreement. Some syndications offer investors the option to sell their ownership interests, while others may have restrictions on early exits. It’s crucial to review the syndication agreement to understand the exit options and any associated fees or penalties.

Q4. Are there tax implications associated with commercial real estate syndication in India?

A. Commercial real estate syndication can have tax implications, including income tax, capital gains tax, and any other applicable taxes. The tax treatment can vary based on individual circumstances, such as the investor’s tax residency status and the duration of the investment. It’s advisable to consult with a tax professional to understand the specific tax implications related to your investment in commercial real estate syndication.

Listen to the article

Listen to the article